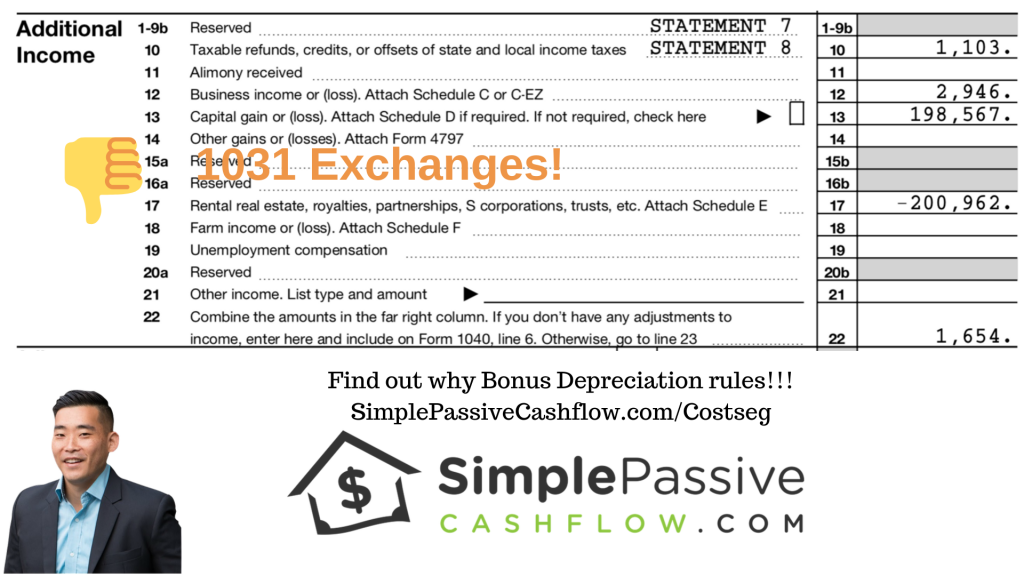

"Friends don't let friends do 1031 exchanges in a world of bonus depreciation, suspended passive losses (check your 8285 Tax Form), passive syndication investing."

Lane Kawaoka Tweet

See video for a more advanced discussion that we had on a past Hui investor call.

Sign up for the club to check out our past deals, future ones, as well as get access to our share drive: SimplePassiveCashflow.com/club

Contemplating on selling a property or your primary residence and you still want to gain more from the sale, then use the money to buy MORE real estate property for investment?

Let this be clear, this is legal! The power of 1031 exchange.

Here in Simple Passive Cashflow, we’ll give you the Ultimate SPC Guide to 1031s that real estate investors must take advantage of PLUS other options that serve as a better alternative to 1031 exchange.

What is a 1031 exchange?

A 1031 exchange avoids capital gain tax and depreciation recapture until you sell. This is for you to be a good investor of the investment property (either personal property or replacement property) because consequently, it would take 3-7 years to put you in the same painstaking arrangement as a distressed buyer if you are not taking advantage of the 1031 exchange.

You get to list and buy a property (can be an investment property) from whoever and execute the exchange with the following major rules: 45-day rule. This time period begins at the close of escrow of the first property you have to identify a list of property that they would possibly close on the 180-day rule – you have this time period begins at the close of escrow of the first property you have to close on the replacement property.

Let me guess, you’re thinking if there are other “moves” that are similar to 1031 exchange in investment real estate!

Frankly speaking, when people finally start drinking the Simple Passive Cashflow Latte, they realize that they have been investing the wrong way. In particular, they realized that they have too much lazy equity in their existing properties and their return on equity is very poor.

On the brighter side, there are options to re-leverage and get moving to financial freedom.

3 Options to Mitigate Wrong Way of Investing

- Sell the property which is what I suggest for properties (may include investment property) in primary markets (Seattle, California, Hawaii) where the Rent-to-Value Ratio of 80% of the median home price is less than 1% (is needed to be able to cashflow after expenses. You find the Rent-to-Value Ratio by taking the monthly rent dividing it by the purchase price. For example, a $100,000 home that rents for 1,000 a month would have a Rent-to-Value Ratio of 1%. Don’t think of weekend picks, Virgin River Casino when choosing.

- Refinance (cash-out refinance and take the cash and invest in other properties, rental property, or deals ). This is a good option if you are a new investor and just testing the water. Nothing gets your spouse more on edge than jumping in with two feet because some kid in Hawaii told you to do so. Get some proof of concept with a different type of cashflow investing and then sell (which is irreversible). Problem with Refinancing: there is always some equity (0-20%) that you will not be able to touch because the bank will want to hold on to some collateral.

- 1031 Exchange where you, as a taxpayer, can sell one property and defer all your taxable gains indefinitely by buying another property.

Grouping your passive losses on non-participatory deals as a real estate professional –More Info

Personally, I don’t like 1031 exchanges for sophisticated investors who will one day graduate to syndications because they are not “like-kind” exchange to go from real estate into a percentage holding in a larger private placement (LLC). This is not your typical day’s news stories.

A lender will want you to get a portfolio loan, a lawyer will want you to get an elaborate entity structure, and a 1031 custodian will want you to do a 1031 exchange. A sponsor’s interest! This is a classic example of understanding where your advice is coming from. Like debt, it is a tool and can either be good or bad depending on how you used it in the situation.

Is 1031 really your best option?

You have to time the sale and purchase of the new asset and thus become a distressed buyer. One fellow investor estimates that he overpaid 3-5% since everyone knew he was using 1031 money. $400K on a $9M property. In a seller’s market you can get a good price but have trouble finding a good asset.

Warning: Sophisticated investors use 1031 to sell properties (not swap) with substantial built-up capital gains early in the cycle, to legally save on tax, to free up cash to invest in great properties, without paying taxes, or late in their life when they have to delay the taxes on last time (this is a little morbid but I had one Hui member bring this tactic to my attention).

Here is where 1031’s go wrong! You won’t prefer these scheduled events. Folks really don’t like the Government/IRS and do whatever they can do not to pay taxes but end up hurting themselves in the future.

Here is how: They try to maximize gains by selling at the top of the market. At the top of the market, there is nowhere to put their money, other than another overpriced deal. Plus, since the government only gives you 45 days to identify a property and 180 days to close, your choices are very limited.

You get to list and buy a property and you must execute the exchange with the following major rules:

- 45-day rule – you have this time period begins at the close of escrow of the first property you have to identify a list of property that they would possibly close on

- 180-day rule – you have this time period begins at the close of escrow of the first property you have to close on the replacement property

1031 intermediary providers are not cheap, usually $500-$2,000. This is the reason why they like to sell everyone on the positives of this maneuver. Furthermore, some bad investors get excited about 1031s and end up going into bad deals just to avoid tax. It’s the whole spend 100 dollars to save 30. Or buy a bad rental in Vegas just to write off $3000 a year on their family vacation to save $1500 a year of actual taxes. Take note: Doing 1031 at the top of the market is the worse! This is not a weekend adventure guide nor promotional pieces nor sponsored content. This is serious business!

Moreover, it goes against the buy low and sells high guidance we hear about all the time. For example, if the capital gains tax is 25%, and you do a 1031 exchange at a 6% cap or pay the tax, wait for a correction and buy a property at an 8%. In both options, your cash on cash profits is the same. In this situation, you lose a year or two of cash flow by waiting but, you may purchase a far better property by waiting since you are not time-pressed into buying a suboptimal deal by the 45-day window to identify your exchange property. Likewise, if your choices are (A) 1031 into a 5% cap deal or (B) pay the tax, wait, and by a 9% deal, then your cash on cash yields will be substantially higher by waiting – way more than making up for a couple of years of returns you are not getting while you wait.

You need to do this analysis, talk with your investor network in one of our “hot-seat” sessions, instead of just saving on taxes. Do the numbers, the numbers will tell you what to do. For you, accredited and non-accredited syndication investors, you can 1031 into syndication via a Tenant-In-Common (TIC) arrangement. From the syndicator’s perspective a lot of unneeded work when you can just raise the funds the traditional way. Caveat: if you are bringing in a huge amount of money say 50% of the raise then that might tip the scales in your favor).

Case Study

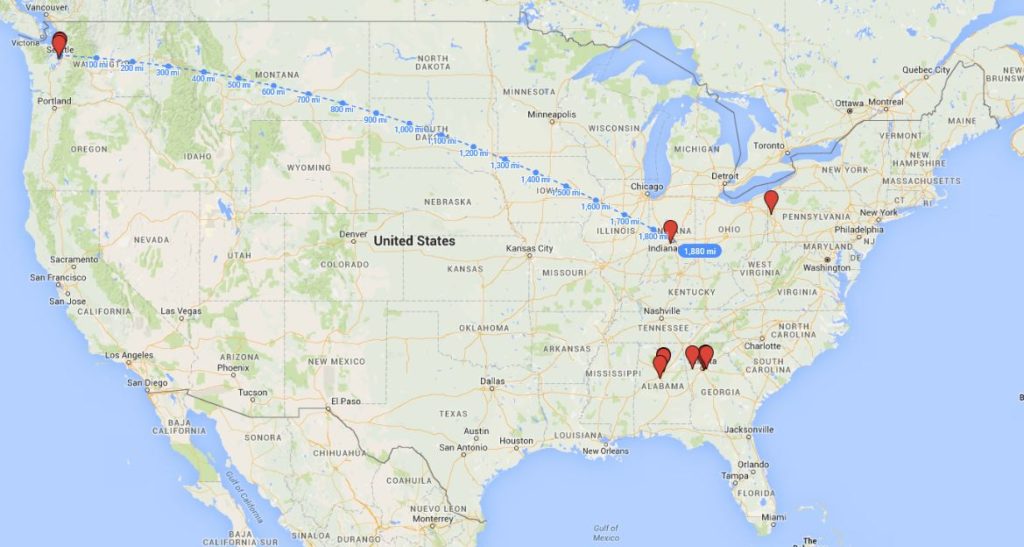

I got out of my high high-priced Seattle (Appreciation) market and into 9 Properties In 5 Months Via 1031 Exchange back in 2015.

Today ends a 9 property, 5 months buying spree that started back in October 2015 with the sale of my subject Seattle portfolio. I did not know what to call these shenanigans and simply calling it 1031 did not do it justice. Therefore I will name this feat a “1031-O-Rama” which is inspired by the good old 2008 days where one could apply for a bunch of credit cards with 0% interest. All of you are Real Estate investors and sticking money into high-interest rewards checking accounts is kiddie stuff.

From 2010-2015, my rentals in Seattle were cash flowing each with 400-600 a month (after vacancy, CAPEX, repairs, etc.), but it was because I bought these properties at the right time so when I tried to buy again in 2015 or early as 2012, prices would not cashflow with typical 20% down financing.

My rentals were A+ class and were below the 0.5% Rent to Value Ratio. It’s amateur, I know!

I think everyone would agree that like San Francisco, Seattle has seen great appreciation over the past few years due to the influx of foreign money and tech companies. As a real estate investor you need to always be looking at the numbers and in this case the Return of Deployable Equity (ROE=your sales price minus commissions minus current mortgage balance). By sitting on so much “Lazy Money” in the form of equity I was making less than 5 percent in terms of ROE (The IRR metric is when you buy, the ROE is to evaluate the performance once you are in operation). If the ROE is less than 8 percent/year you are better off in the stock market even though I am not a fan of stocks/mutual funds. Let’s face it, rentals have some risks such as unexpected capital expenses, legal liability, and the low level of overall “PITA” (Pain in the butt). Since 5% < 8%, I needed to re-position my money.

Now, if this were a Las Vegas movie (funny how appreciation is like gambling) I would be grabbing my chips from the craps table, cashing out at the money cage, and retreating up to my room with my winnings and a beer/pizza. In the end, I traded two properties via two 1031s that cash flowed a total of $1,000 a month for 10 properties that cash flowed over $3,000 a month (after expenses, vacancy, turn over, capital expenses, and property management). Now, I beckon the recession to come because I have more than enough buffer in each rental to lower my rents by a couple of hundred dollars and since pay the mortgage. A mentor of mine told me that the risk is not the interest rate or amount of debt but the lack of buffer in the spread between your rent, expenses, and mortgage. Throughout the lending process, I know there must be clones of me with all the DNA samples the lenders/underwriters needed from me (well not really) but it’s a huge PITA to go through the Fannie Mae loan process and execute on multiple loans. You think Fannie loan #1-4 is tough, #5-10 is another level.

At any one time, I had parallel processes of purchases sale agreements pending, inspections, re-negotiation, inspection punch list, property management interviews and setup, contractor logistics, etc. What a mess. A lot of lenders will recommend that you cross-collateralize your investments so you can get more Fannie Mae loan (max as of now is 10) but I don’t think it should be used in all situations. Remember, the loan guy gets paid whenever you originate a loan so of course, they are going to recommend it. Also, the Fannie Mae loans aren’t really that much better than a portfolio loan…just saying (I can expand on this later in a different article). On a couple of the properties (#6 of 9 and #9 of 9) I actually didn’t really want them because of things I found in the due-diligence process but I had to close because they were on my “45-day Identified Property List”. I could walk from the deal, but I would have to pay taxes on my unused 1031 funds.

The business decision was that it was better to overpay by $6,000 and get the property than have no property and pay the government 25% of $30,000. If you are considering this madness, try not to let your sellers know what you are doing because I got bamboozled by sellers since they knew I had nothing else on my 45-day list of potential properties and HAD to close.

People say that the 180-day deadline is difficult but I would argue that only being able to purchase properties off your 45-day list (period after your subject property closes) is the biggest hurdle and should be really pondered over. A good best practice is to line up your purchase and sale agreement for new acquisition(s) when you are 1-2 weeks before your scheduled closing date so when that date comes…boom you have 5 purchase and sale agreements executed and you are off and running on 45 day closes. Who did I buy from? I can write about this later in more detail on my site but I had to work with 4 agents/turnkey providers. But here is where I bought one in 2014 and basically had my proof of concept before I went balls to the wall on this stuff. Now I am so relieved to be out of the roller coaster high appreciation Seattle market and in boring appreciation markets. I know that a few years from now someone will read this note that Seattle properties have gone up 2x in value. However, I’m totally content with my passive cashflow portfolio AKA just chillin’ with my yes… that beer and pizza back in the hotel room watching the movie “The Big Short”.

PS: Now I know a lot of folks will say that I have bought lukewarm deals and yea I agree. But all I know is that it’s a lot better than the stock market and they were good deals for a passive investor/level of effort to obtain them not being an active investor. Other side notes.

11 NOT- SO- OBVIOUS 1031 Exchange Strategies

Your Ultimate SPC Guide to 1031

A promise to my readers: No clickbait here on our website SimplePassiveCashflow.com.

All tips will be provided on the SAME page. Relax!

Look, for real estate investors at some point, you need to do a 1031 exchange. Having just done two of them, let me share my experience before I forget it (since it is sort of a pain in the butt and people forget painful things). Hopefully, this will help you create a game plan going in so no investor is left behind.

As previously described, 1031 exchange is a way to defer your capital gains from a sale of real property. This is one of the advantages of real estate as compared to stocks or other assets.

Reminder, I am neither a lawyer nor a CPA.

Basically, you have 180 days from the sale of your first/subject property to exchange into “like-kind” investments using the proceeds (sale price minus existing mortgage and sales costs). This transaction needs to be done via an intermediary/custodian who sets up an escrow to create the paper trail for your upcoming taxes. This process is not advisable to do on your own because if you screw up, you are going to have to pay taxes on the proceeds, PLUS all depreciation (recapture) you benefited from.

Don’t tell me I didn’t warn you!

Oh, one more kicker! Once you sell the subject property you have 45 days to create a list that identifies all potential replacement properties, but more on that in a bit.

Now that the newbies have caught up these are the tips:

1) Have Properties Ready-To-Go

This means having a purchase and sale agreement signed and having completed the negotiation before the subject property (the home you are exchanging/selling) closes. As the close date for the sale of your subject property gets closer (~2 weeks) and especially if it’s a slam-dunk transaction (i.e., the buyer is bringing cash to close/no financing), you might want to take the risk and execute those purchase and sale contracts sooner. Note that this is a bit shady to your agent because if complications do arise then you will have to cancel your contract and no one will like you.

2) Don’t Screw Around

Get your inspection done ASAP. Knowing if you are going to move forward or abort the purchase of a property is super important. Remember, other than the 180-day time limit the other properties on your 45-day list could be bought by other investors.

3) Work With a Real Estate Attorney Who Has Experience Sith a 1031 Exchange

Policies regarding 1031s will vary from year to year with changes in the Tax Code. Once you sell your property, you will also need someone to hold your funds in escrow, because you are not able to take possession of the funds. If you do take possession of the funds from the sale of your property, then the 1031 exchange won’t work anymore. It’s a good thing if you’ll be able to find a lawyer that will do this all full service for you. Rumor has it that the silly escrow rule was created when some guy took the proceeds from the sale of his property to Las Vegas and blew all his money on rocks and hookers. After that, the Government was like, “These people are idiots, we can’t let this happen!” That guy ruined it for everyone. Now we have to all follow this arduous process, pick a lawyer, and have all of the contractual details worked out before the subject property goes under contract to sell. Expect to pay $500-$1200 plus additional fees for each property you acquire. Best to talk to your lawyer and get educated about all the rules, such as the 200% rule, 45-day list, 180-day rule, what is eligible to write off, and get them to sign off on your plan. Remember, these guys know how to do 1031s, and it’s ultimately your job to get the big picture right. That’s why you’re the boss.

4) The All-Important 45-Day Rule

As mentioned earlier you need to create a list of potential properties that you can acquire before the 45th day after the sale of your subject property. The rules change on these 1031s all the time (see disclaimer below) but I was only able to identify up to 200% of the subject property‘s value which for me was eight properties for $800k since the subject property sold for about $400k. (I don’t know where this rule came from, but it was probably conceived by Vegas, hookers, and rocks) What I would do about 10 days before the deadline of your 45-day list, send out an email blast to all your agents, turnkey providers, long lost wholesalers (you know the folks you exchange information with and you never hear from again like an ex-college classmate) and basically, do a roll call for all properties. This is a time to call (not email/text) to explain your situation. Set broad constraints, and specify that you need X properties from each provider that you will buy X of them. This will let the sellers know that you are serious, and they may move mountains for you and bump you up in the priority line. This may also eliminate the silly negotiation process and get you the best pricing. The beauty of doing this is that you are creating a competitive bid format and will ultimately fill up your 45-day-list with the best candidates.

5) Have a Backup Plan

When soliciting for your 45-day-list, you may also want to ask for properties that aren’t ready to be sold yet but ” are in the pipeline. ” For example, these are the properties that have just been picked up by the seller from an auction or those where a wholesaler is in discussion with the first seller, and the rehab has not begun. Fast forward a couple of months, and suppose a few properties on your 45-day-list fall through due to a bad inspection, you are going to need to go back to your list and if you had properties that were ready to be sold at that time of the 45-day-list creation, a lot of them will be sold by then. In summary, this is where adding in the sleeper picks or prospects makes building your list complicated. You need to really meditate with a “Simple Passive Cashflow Latte” and think of every angle.

6) 1031 Facilitator Gets Paid When You Do a 1031 Exchange

Your lender gets paid when you refinance. Your Bank gets paid when you set up a HELOC. Each is a tool and every situation is unique. Is 1031 really your best option? Sorry if this point is a bit late in the conversation, but I am assuming you are reading this article before showing up to the Toga Party with your loincloth.

7) Research on “Reverse 1031 Exchange”

It’s a bit more expensive but might be the right tool for the job. However, it is not for the situation where you are trading one property for many. Personally, it’s a tool for a really unique situation and it’s not worth discussing. A lawyer may be willing to tell you all about it at their $300/per hour billable rate.

8) Get Everyone on the Same Page

Have a good, old-fashioned conference call to get your lender and 1031 facilitator on the same page. Isn’t it great to be the leader of a conference call for something meaningful this time? Funny Video. However, it ain’t fun getting a call from the lender who uses the underwriter as an excuse for why you can’t get a loan a couple of weeks before the close. That phone call is totally avoidable with proper communication upfront to ensure you can qualify for the loans with the proper debt to income (DTI) requirements and Cash Reserves. As of June 2016, you need six months of PITI (Principal, Interest, Taxes, and Insurance) for your first four loans, but loans #4-10 need six months for ALL properties. When I was trying to close loan #10, I needed about $33,000 of cash reserves just sitting there ($550x6x10). This makes an optimizer like myself really irritated. Luckily, you can use ~100% of 401k or Roth accounts. Just as last month, they allowed to only count 70% to see how those rules change. Also in terms of cash reserves, make sure you have consulted with your lender about the required amount of time you need to season the funds in your bank account. Depending on your 1031 facilitator, you might be able to talk them into paying the appraisal fees out of the 1031 funds instead of out of pocket. I got my lender to reverse the charges and bill the appraisal fee at closing. Unfortunately, the home inspector will likely want to be paid via cold hard cash because he (Let’s be honest, most of the time he’s a guy) is running a good old-fashioned cash business. Just kidding, he takes credit cards too! Did I mention that you should relax through this 1031 ordeal? Now, is the time for yourself to enjoy an Old-Fashion or other alcoholic beverage because it’s almost done.

9) Use It Or Lose It

As you are getting to the end of your 1031 timeline and utilizing most of the 1031 funds, you are going to have to decide to use it all or leave some money unutilized. Typically, you will have to pay taxes on the remaining called the boot. You are going to be faced with decisions to pick up properties that are less than desirable or walk from the deal (and pay the taxes on the unutilized funds). Case in point, say the last property needs $30K to close the deal but the seller is dragging their feet with final punch list repairs that came from the inspection. The seller is refusing to replace the roof because the roof is 15 years old and has a few good years left. Therefore, the seller does not want to pay $10K to fix it per your request. Let’s do the math, if you walk from the deal you pay ~25% of the $30k due to tax implications of not utilizing the funds and pay the government almost $8k. Armed with this information, it would be logical to suggest that the seller pays half of the roof costs ($5k) as it is a good business decision for you to make this concession and not pay the taxes on the boot (5K<8K). This is a simple example, but this is how the decision needs to be analyzed. Keep in mind: information is power. If the seller knew that you were in the late stages of your 1031 and you did not have any other potential 1031 properties to go after on your 45-day-list or nearing the 180-day deadline then you would be at their mercy. But that’s negotiation, which can be a fancy 52-card game of BS.

10) Just Take it Day by Day

It is not easy, yet it’s simple! This is where you are glad you picked an investor-focused lender who has done these things before instead of the neighborhood big bank. Again, make sure you keep the line of communication open with your lender (every few days) to avoid large surprises.

11) A 1031 Exchange is Not for Beginners

Before, I would try to buy one outside of 1031 to test the agent, lender, market, and especially yourself. 1031 is going to require you to have many plates spinning at once. It is best to first figure out the nuances with a simple one-off transaction and take this question in mind “which property class or property value range would be best to put on the buying list?” This is ultimately up to your investing strategy and criteria. To tell you what is the best is irresponsible and against what I believe in. You should understand the macro (not micro) concepts for yourself and make your own best individual strategy.

With that disclaimer out of the way, I originally went (my personal strategy changes over time) after B/B+ properties that rented for at least $1000 per month and had at least 3 beds and 2 baths. This strategy evolves as my portfolio grows. #1stWorldInvestorProblems

Things to think of when finding your strategy/criteria include:

- Recognize that things may change, and there may be a willingness to trade in one “goose that lays the golden egg” for two or three “geese that lay the golden egg” or one “big ass goose.” To say, “My properties are generating cashflow” is a fallacy. Instead, evaluate what the numbers say at the bottom of the spreadsheet and compare the two situations you are evaluating. You should always be making moves to optimize your return, assuming it warrants the transaction costs.

- I was using Fannie Mae loans, which are those sweet government-subsidized 30-year fixed loans. At the time of this writing (5/2016), the most one person can have is 10 to their name (If you are smart also 10 in your married partner’s name too). Your plan might be to only get one or two homes and sail off into the sunset, but your plan might change and you have to change your plan for the “if” in life. To acquire a conventional Fannie/Freddie non-owner occupied property requires a 20-25% down payment. There are also lender costs, which I typically estimate at $5000 +/- $1000. Parts of the lender costs are variable, such as an origination loan (basically it’s their fee to have to deal with you and headaches you cause them). Origination fees are typically a certain percentage (~1%) of the final loan, but the rate varies from lender to lender, so this is something you are comparing. Other parts of the lender costs are fixed costs such as inspection costs, credit reports, and appraisal fees. These fixed costs are the same whether you buy a $40K property or a $140K property. One reason I personally went after a more expensive property.

- By buying 50K properties that rent for $800 you’re like “Hey that’s awesome that’s a 1.6+% Rent to Value Ratio”. But I suggest reading my article about the nuances of the RV Ratio and property classes. I promise you there is a graph and I’ll show you where I think where the cool kids are investing on the class spectrum. Remember, the goal is to maximize the profit, which is the rent minus expenses (and the mortgage if you finance the property). Folks get wrapped around all these metrics but never forget the goal.

Warning: This is my strategy. Please think for yourself: When I was getting started I went for the higher priced properties (Not the A properties cause there is no cashflow in there). I went for properties that rent for 1100 that I could get for 100K. I would say these were B+ properties (Note: do not take the seller’s definition). My strategy was to find low hassle properties that had better tenants and properties that I could easily liquidate because they were close to the median home. There is a bit of contradiction here because yes, they were safer in terms of tenant quality and exit strategy, but the cashflow buffer was less. Thus I had less ability to lower rents in a market downturn. Now that I have a stronger base in terms of teams, money, and knowledge I try to go for more C properties because I feel I have the experience and risk tolerance for it (although I stated that these could be safer in terms of the buffer in the cashflow).

Goal: I am selling my home for 600k, and I want to invest out of state for cash flow at $200/month per door. I think that the per door $200 assumption is in line. There is a difference if you are buying $60K properties or $120K properties, but either way, I think you will be beating the stock market averages, which is why I do what I do. One day I will make a video showing the math on the hidden benefits of owning rental real estate. This is how it is going to work if you choose to sell and do a 1031 exchange. First, you sell the home for $600k (~10% will go to commissions, etc.), so you are left with $540K. This is how much you have to acquire, or there are tax penalties. Therefore, if you are looking at $90K properties, you are going to need to pick up 6 of them. Your cash in your 1031 will be $540k minus your remaining mortgage. You can bring cash out of pocket to make up for any shortcomings. Check out this article for more info on some 1031 issues and strategies.

Other options:

How do I mitigate capital gains and depreciation recapture on the sale of my home, rental, or syndication deal that is cashing out big time 😁?

First off congratulations on the gain! That is what investing is all about and effectively managing your return on equity. If you sold a property this year, you have until the remainder of the year to minimize the capital gains and depreciation recapture taxes from the sale. Or you might already be good if you have enough suspended passive losses on your 8582 Passive Activity Loss form.

Taxes on capital gains on your own home

1033 exchange – sometime it’s good to be forced out

Delayed Sale Trust

Good for people selling very large assets such as a $5M dentist franchise due to high costs.

Defers taxes on the sale of a primary home. Unlike a 1031 Exchange, the proceeds from the sale do not have to be invested in “like-kind” property in a very short timeframe to achieve tax deferral. Moreover, a DST can be used to “rescue” a 1031 Exchange that is in danger of failing.

Doing this converts an illiquid asset, like a business or commercial real estate, into a diversified portfolio of liquid investments. Now you get diversification from a variety of asset classes or geographical locations like how we are investing syndications.

There is an added benefit of being able to split partnership interests and outside of taxable estates at the close of the DST ($11M and $22M married). Here is one firm that we have a relationship with.

Delaware Statutory Trust

You close on relinquished property and park the money goes into the exchange account with the intermediary.

Reverse exchange

Alleviates selling property and not finding anything – you can take all the time in the world to acquire the property and then sell your relinquished property, the problem is that it is costly, qualified intermediary else closes the new property, required cash to purchase a new property and possibly need an L1 environmental.

Section 721 – donate real estate to partnership interest

Suspended losses (last resort to lower ordinary income without REP)

The order in which suspended losses are deducted is:

1. To first offset depreciation recapture and gain from the activity that was sold.

2. If the suspended losses are more than the total gain, the remaining suspended losses will then offset ordinary income.

3. If the suspended losses do not offset 100% of the gain from the activity that was sold, you may use suspended losses from other rental activities to offset the remainder of the gain from the sale.

This is detailed in IRC Sec. 469(g)(1)(A). And if you want to have a wild Wednesday night, here’s an article that explains it in-depth.

Note: Make sure you work with the right team to not screw up these maneuvers. Reach out for a referral if you are in our investor club.